Olivia K. Smith, Attorney at Law, will advocate and support you when making decisions concerning your well-being, care, and treatment as you age, preserving your home and assets when seeking solutions like government benefits for long-term care needs. The right legal strategy for your situation may be a combination of the following:

Olivia K. Smith, Attorney at Law, will advocate and support you when making decisions concerning your well-being, care, and treatment as you age, preserving your home and assets when seeking solutions like government benefits for long-term care needs. The right legal strategy for your situation may be a combination of the following:

- Estate Planning

- Medicaid & Long-Term Care Planning

- Probate & Trust Administration

- Special Needs Planning & Trusts

Estate Planning

Estate planning as we age is not just about what happens to property and assets after death. It also includes elder law services like long-term care planning and Medicaid planning. Seventy percent of all seniors will need some type of long-term care during their lifetime. Even if you’re healthy today, the odds are you’ll require long-term care at some point — and the costs of that care can be staggering.

What Does Long-Term Care Cost in Ohio and Kentucky?

The cost of different health care services, such as in-home and nursing home care, continues to rise and may greatly affect your savings, retirement funds, and the assets you plan to pass down to your family.

The annual median cost for care in Ohio and Kentucky ranges from approximately $60,000.00 to $110,000.00.

- The average net worth of someone between 65 and 74 is $266,400.

- Nearly 17% of the US adult population provides unpaid care to adults over 50.

- The cost of care in the home is $27.50 per hour or roughly $5,000 per month.

- About 70% of people aged 65 and older will need some type of long-term care during their lifetime.

- The average nursing home stay is 7 years.

- Experts estimate that the costs of nursing home care in 2023 will triple in the next 30 years.

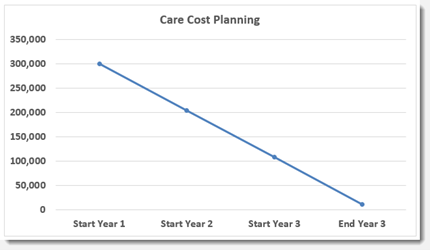

Assume the cost of skilled care nursing is $10K per month. You have a monthly income of $2000 and $300K in assets. Without planning, your money will last right around three years if you take no steps to protect your assets. The implications of there being a spouse still in the community are huge.

MEDICARE LIMITATIONS

- Medicare may provide up to 100 days in a skilled nursing facility (SNF) if discharged to a SNF from the hospital after a 3-day stay.

- Medicare will only pay in full for the first 20 days of your stay in a skilled nursing facility.

- Everything beyond the first 20 days is subject to a daily copay if the proper supplemental policies have not been chosen.

- After day 100, the patient pays the full amount.

This is why Medicaid is often the better choice for long-term care. The key to applying for Medicaid and reaping the benefits is to use all planning tools and strategies available to you. Because the states of Ohio and Kentucky will look back on your assets and financial activities for five years before the start of your Medicaid application, it’s best to be proactive and start planning right away. As the saying goes, an ounce of prevention is worth a pound of cure.

If these numbers seem overwhelming, Olivia K. Smith, Attorney at Law, can help ease the financial burden of expensive care. Making the best decisions for you and the people you love as they age requires understanding what your family could experience if you or another family member faced extensive long-term care needs. Long-term care planning involves educating you about options and preparing personalized legal documents to ensure coverage of potentially extensive medical costs while preserving your money, assets, income, and personal wishes for care.

Medicaid

Qualifying for Medicaid may be one way to minimize the long-term care cost burden, but doing so requires strategizing financial reorganization and legal planning. Eligibility requirements are complex, and it’s best to prepare at least five years before the need for benefits. An immediate need for nursing home care leaves fewer options, but it’s still possible to save time and money by relying on an experienced Ohio or Kentucky elder law attorney to qualify for Medicaid quickly. Do not spend all the money on the nursing home first and then speak to an attorney. Speak to an attorney immediately upon admission or imminent admission into a nursing home.

There are generally two types of Medicaid planning that can occur. The first type is referred to as Proactive Planning, and the second type is referred to as Crisis Planning.

Proactive Planning

Proactive planning for long-term care is a viable option for individuals depending on their asset structure, age, and health conditions. The purpose of proactive planning is to initiate the gifting process sooner to work around the sixty-month lookback period. Any applicant for Medicaid has a legal duty to disclose any “improper transfer” that occurred during the prior sixty months. An improper transfer is a transfer to someone or something (e.g., an irrevocable trust) which was done for less than fair market value. If you have made an improper transfer (aka a gift) during the sixty-month window, Medicaid will penalize you, the applicant for Medicaid, using the following formula:

Gift amount/penalty divisor* = the number of months you will not receive Medicaid benefits. This can have huge implications on your ability to receive care from a nursing home. Therefore, we recommend against gifting without a plan and understanding the implications of such a plan.

The best way to gift, most of the time, is by setting up an Irrevocable Medicaid Asset Protection Trust and transferring certain assets to it. The moment the asset is transferred to the trust, the sixty-month lookback “clock” starts ticking. The goal of this type of planning is to make sure the sixty months from the date of the transfer do not overlap with the sixty-month lookback period at the time of a Medicaid application. There are various reasons a trust is better than directly gifting to a child or children if using Medicaid to pay for long-term care is a possibility in the future.

An Irrevocable Medicaid Asset Protection Trust has certain requirements which must be implemented to make it effective. First, you can’t be the trustee of this type of trust. Secondly, you have to give up legal control of the asset. Meaning once the asset transfers to the trust, you can’t legally require the asset to be transferred back to you. This can be a scary proposition. Proactive planning may not be for everyone, and that’s okay. Additionally, qualified money (e.g., IRAs, 401ks, etc.) are not viable options to transfer into this type of trust without a total liquidation, which is usually not the best plan. Real estate, cash, and investment accounts are good assets for this type of planning.

Crisis Planning

Crisis planning is the type of planning undertaken when an individual is already in a nursing home or will be soon. When this happens, the sooner you can reach out to an attorney skilled in this area, the better. The planning techniques used will depend on a few factors, including:

- Whether you are married or single.

- Whether you have the capacity to sign legal documents or have adequate power of attorney documents in place.

- The amount of assets in your portfolio.

- Your income level.

This is an extremely complicated area of law, so don’t try to do this on your own. The key thing to know about crisis planning is to seek legal assistance as soon as possible.

*From time to time, this divisor number will be changed by the state. Olivia can provide you with current information on the current penalty divisor.

If you have questions, contact us to set up a consultation. We can be reached by phone at 513-672-6119 or by email at oksmith@cmrs-law.com. Our office is in Cincinnati, OH, with clients throughout the Greater Cincinnati area, Northern Kentucky, and the surrounding counties.