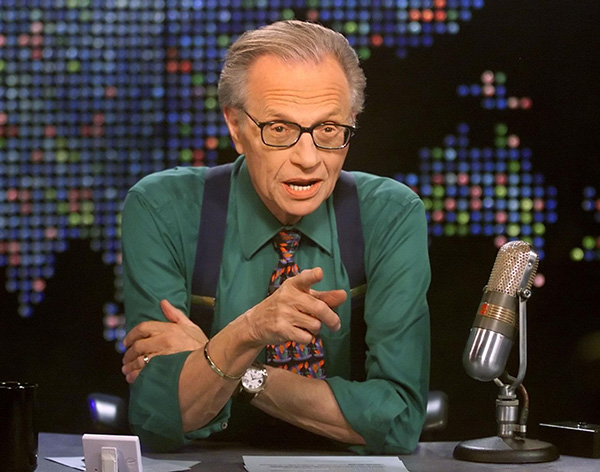

Larry King’s Unfortunate Legacy

The legendary talk-show host, Larry King, died at age 87 on January 23, 2021, after contracting Covid and then succumbing to an infection. He married seven women and had five children between several of them. Immediately after his death, his…